How a massive oil-drilling company sells a million kids’ toys a year – Sherwood News

On the day that oil giant Chevron disclosed it would acquire Hess in a merger deal valued at $53 billion, Hess issued a separate but equally significant press release.

“An Important Hess Announcement,” read the October 2023 statement, which wasn’t filed with the Securities and Exchange Commission but could move the market — the toy-collectibles market, that is. “We want to assure all of you that the Hess Toy Truck, a long-standing, cherished tradition, will continue on for future years!”

For its everyday business, Hess is a huge oil and gas producer that ranks 378th on the Fortune 500. It jams gargantuan drills into the ground and builds towering steel rigs offshore in the Gulf of Mexico to extract crude oil and natural gas from the ground. It even explores for petroleum products in places like Guyana and Malaysia.

Oh, and it also makes some of the hottest Christmas toys on the planet.

Every year, Hess sells over 1 million toys, largely around the holiday season, and it claims to be the largest direct-to-consumer toy seller in America. Doing some back-of-the-envelope math, with a selling price of $46 each for the flagship Hess toy truck, you could ballpark the company at around $46 million in revenue from toys each year — much lower than what it gets from drilling, but still not an insignificant chunk of change.

Hess trucks are its best-known product, but the company has also made helicopters, trains, space shuttles, and basically any vehicle that rolls or flies.

“It’s not competitive with anything else,” said Christopher Byrne, a toy-industry expert known as “The Toy Guy.” Hess trucks sit somewhere between Tonka, Green Toys, and branded construction toys from John Deere, Caterpillar, and corporate offshoots from the likes of McDonald’s, which launched Happy Meal toys in 1979.

Credit for this unusual side business goes to the energy producer’s founder, Leon Hess, who grew up during the Great Depression and began a heating-oil delivery company in New Jersey in 1933. In 1960 the company opened its first Hess-branded gas station and four years later began selling its first toy, a Hess Tanker Trailer. Every year since, in time for the holidays, Hess rolls out a new truck.

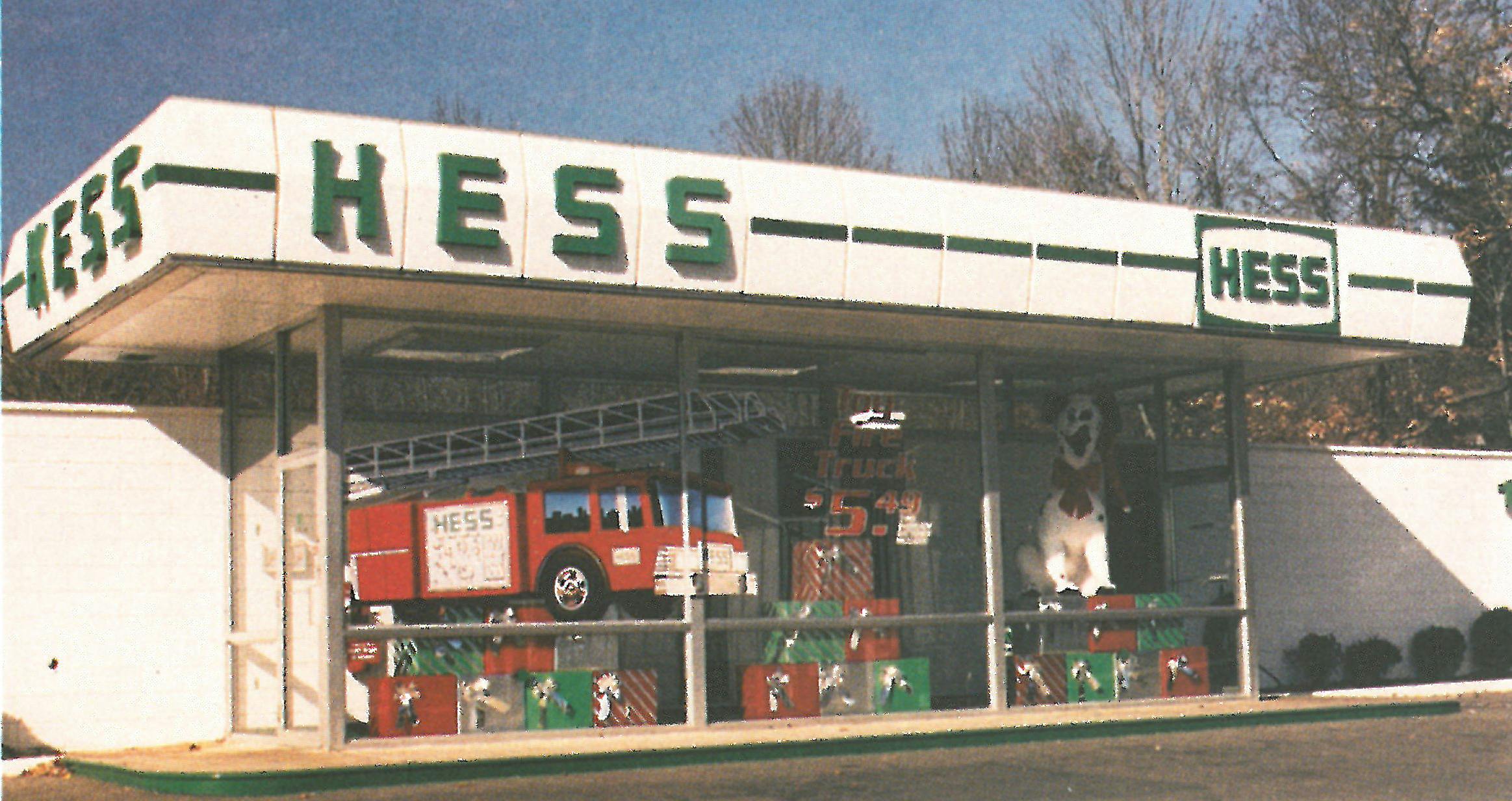

Hess got the idea to begin making toys after a meeting with toy manufacturer Louis Marx and Co., which later sold to Quaker Oats and was liquidated in 1980. Hess trucks, despite being wildly popular, have remained quite distant from the rest of the toy world. They’ve never been connected to the industry’s titans, Mattel and Hasbro, nor sold in any retailer — not even Toys R Us. For the first 50 years, the only way to buy a Hess Toy Truck from the company was to visit a local gas station.

“He thought it would be a really great way to thank his gas-station customers,” Justin Mayer, general manager of Hess Toy Trucks, said. “One of the reasons I love the job is because I feel a little bit like Santa.”

The original 1964 Hess Tanker Trailer, a replica of the company’s B61 Mack truck and trailer, had working headlights and a rubber hose, rare for toys sold at the time. It sold for $1.29 (some collectors say $1.39), which is worth roughly $13 today. Hess’ marketing evolved from newspaper ads to television commercials that began to air in 1980. The toy even got a jingle: “The Hess Truck’s back and it’s better than ever!”

The annual release proved so popular that each Thanksgiving weekend, traffic would engulf Hess stations across New Jersey. It became such a hassle that the Garden State’s then governor, Thomas Kean, asked Leon Hess to move the launch date. He wanted to avoid paying state troopers overtime.

Hess now launches the holiday toy in October, and this year is selling a Hess fire truck that comes with a car and motorcycle and retails for $45.99. The newest rig comes as Hess’ deal with Chevron is trucking along, winning conditional Federal Trade Commission approval in late September.

Since 1998, Hess expanded the toy portfolio and now sells a miniature collection, plush toys meant for younger children, and premium-priced toys for collectors. “When they’re sold out, that’s it,” Mayer said.

Mayer has worked at Hess since 2007, primarily in marketing roles associated with the gas-station and convenience-store businesses, but he became fully focused on the toy trucks after Hess sold the company’s gas stations to Speedway. That led to another freak-out among fans, resulting in Hess having to publicly offer reassurance that the toy trucks would retain their branding even after the gas stations were renamed.

If Mayer is Hess’ Santa, then Michael Roberto is “Father Hess.” Roberto’s the author of a self-published Hess Toy Truck encyclopedia that’s meant to guide collectors. “We’re all still kids inside,” Roberto said.

His introduction to the brand was a cherished memory with his father, who took him to a Hess station in the Bronx and bought him the toy truck that would remain his lifetime favorite, the 1977 Hess Tanker Truck.

“Little did my dad know that that one little, simple act of taking me to go get a Hess truck would shape my life,” Roberto said.

At one point Roberto owned three versions of every annual release from Hess. One toy would remain untouched in the box, another would be placed in an airtight display case, and a third would be opened for his children to play with. But when Roberto was stung badly by the 2008 financial crisis, he was forced to sell some of his prized possessions to cover expenses.

There’s also a rabid market for Hess truck collectors. The highest known price for a Hess toy truck sold online between two collectors is $12,000, for a rare 2003 Hess truck and racer set.

Jack McCaffrey, a 25-year-old schoolteacher in New Jersey, recalled that he once had an opportunity to complete his Hess toy collection, but at a staggering price of $3,000. McCaffrey received his first Hess toy in 1999, the year of his birth, and has collected every holiday truck ever since. One glaring omission from the collection he’s amassed so far: the original 1964 Hess Tanker Trailer.

“There’s something oddly charming about Hess,” McCaffrey said. “It appeals to that part of all of us that doesn’t want to grow up.”

He has backfilled his collection and now owns every holiday launch since 1980, as well as the 1977 Hess Tanker Truck. McCaffrey also runs a Hess fan page on YouTube, where he reviews each Hess toy he owns.

Completing his collection is only a matter of time. But the more pressing issue is that he would like to move out of the home he shares with his parents.

McCaffrey said, “It’s really a question of, where does my toy collection go when I move out?”

John Kell is a New York-based freelance writer, covering consumer trends, technology, leadership, and sustainability. He has reported for Fortune Magazine, Business Insider, Fast Company, Forbes, and The Wall Street Journal.

Potbelly shares are trading down more than 18% on Friday after the sandwich chain with roughly 450 locations reported earnings Thursday afternoon.

The chain — the only major publicly traded sub joint, by our count — beat Wall Street estimates on revenue but issued guidance for a same-store sales decline of up to 1.5% for the current quarter. The reason: blisteringly cold temps and brutal winter weather in the Midwest, particularly Illinois (where more than a quarter of Potbelly stores are located).

Q4 capped off a fiscal year of stagnant or declining company-owned same-store sales for Potbelly, a steep drop from previous growth rates.

It’s hard to say whether Potbelly is doing uniquely poorly at the moment or if America is just more broadly out on hoagies at the moment. Larger rivals like Subway, Jimmy John’s, and Jersey Mike’s are all privately owned, with several having been scooped up by private equity in recent years for party-length sums.

Blackstone snagged Jersey Mike’s for $8 billion last year, and Roark Capital bought Subway for a reported $9.6 billion in 2023.

US airlines are having their second-worst week since peak Covid, with the S&P Composite 1500 Passenger Airlines index down more than 13% as of Friday afternoon.

Only the week of March 4, 2022, when the index fell nearly 15%, saw the sector post a worse weekly performance since the peak of the pandemic.

Delta, JetBlue, United Airlines, and American Airlines are all down at least 10% over the past five days, as investors grip the armrest with one hand and slam the help button with the other over President Trump’s tariffs.

Carriers were smacked when tariffs went into effect on Tuesday, then climbed briefly Wednesday as exemptions were announced. Ultimately, fears around the effects of tariffs and a market drawdown on discretionary spending skidded airlines into their latest downturn.

The Trump administration’s move to end the collective bargaining agreement it has with 50,000 TSA officers — a move similar to plans spelled out in “Project 2025” — also can’t be helping.

After years of store closures and slumping sales, the ’90s mall staple may finally be finding its footing.

Walgreens is officially leaving Wall Street.

Shares of the beleaguered pharmacy chain leapt nearly 8% Friday morning, cruising toward the agreed-upon takeover price of $11.45, after the company agreed to be sold to private equity firm Sycamore for $10 billion.

Stocks typically rise to just under the deal price once a merger deal is official, pricing in a bit of risk in case something derails the process. In this case, shareholders will also get up to an additional $3 a share in cash depending on how much certain Walgreens assets get sold for in the future.

According to The Wall Street Journal, the firm is expected to sell off parts of Walgreens’ business or partner with others to support a turnaround. The deal, set to close in Q4 of this year, values Walgreens at a fraction of its 2015 peak. Including debt and potential future payouts, the transaction is valued at nearly $24 billion, making it one of the largest leveraged buyouts of the past decade.

Stocks typically rise to just under the deal price once a merger deal is official, pricing in a bit of risk in case something derails the process. In this case, shareholders will also get up to an additional $3 a share in cash depending on how much certain Walgreens assets get sold for in the future.

According to The Wall Street Journal, the firm is expected to sell off parts of Walgreens’ business or partner with others to support a turnaround. The deal, set to close in Q4 of this year, values Walgreens at a fraction of its 2015 peak. Including debt and potential future payouts, the transaction is valued at nearly $24 billion, making it one of the largest leveraged buyouts of the past decade.

Nintendo shares sank more than 9% during Tokyo trading, their biggest sell-off since August. Just after the US market open, ADRs listed here are trading down 6.8%.

The dip appears to be a reaction to President Trump’s increased tariffs on China, which jumped to 20% on Tuesday. A huge amount of console manufacturing occurs in the country, and many parts are sourced from there. Investors also sold off Tokyo-traded shares of Sony, which fell 4% overnight, and Konami, which dropped 7%. (Sony ADRs were down only 1.5% in US trading after the open.)

Investors are worried that Nintendo could raise the price point of the Switch 2 in response, potentially hurting initial sales. About 40% of Nintendo’s console sales come from the US. Video game analysts that spoke with Sherwood News called trade policy uncertainty “the paramount risk” for Nintendo’s upcoming Switch 2 release.

Nintendo addressed tariffs on its earnings call last month, stating that Switches are also produced in Vietnam and Cambodia.

“A certain impact is expected, but the impact on our performance this fiscal year will be minor,” Nintendo President Shuntaro Furukawa said at the time.

Add a review

Your email address will not be published. Required fields are marked *